Flying Hippo Technologies Limited, operating under the trade name Matrixport HK, has officially submitted its application to the Hong Kong Securities Regulatory Commission for a virtual asset trading platform license.

This application, lodged just days before the critical deadline of February 29, 2024, signals a significant step for the company towards achieving legitimacy within Hong Kong’s tightly regulated crypto sector.

Matrixport Submits Hong Kong Crypto License Application

As of February 28, 2024, Matrixport HK becomes one of the 21 applicants vying for a coveted virtual asset trading platform license issued by the Hong Kong Securities Regulatory Commission. The crypto platform currently has its headquarters in Singapore and serves customers across Asia and Europe.

However, the firm is hoping to add Hong Kong to this list. Its move is particularly noteworthy, considering only two crypto exchanges in Hong Kong have been granted digital asset licenses so far.

The rush to comply with regulatory standards highlights the critical nature of the February 29 deadline. After this date, unlicensed operations will need to cease business before May 31.

Read more: 10 Best Crypto Exchanges And Apps For Beginners In 2024

Matrixport HK’s last-minute licensing bid clearly indicates the company’s determination to operate within the legal framework established by Hong Kong’s authorities.

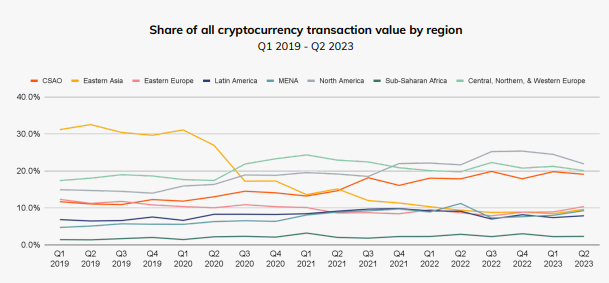

Hong Kong is becoming a pivotal East Asian hub for digital asset exchanges. This has led to a tightening grip on the crypto industry, particularly focusing on over-the-counter (OTC) crypto services.

Tightening the Screws

The city hosts an extensive network of approximately 450 shops, ATMs, and websites dedicated to facilitating OTC crypto trades. This network has been instrumental in managing the city’s substantial $64 billion digital asset flow.

However, concerns over illicit transactions and financial instability have pushed the government towards implementing stricter controls, aiming to funnel the flow of digital asset transactions through regulated exchanges.

Read more: Crypto OTC: How OTC Cryptocurrency Trading Works

“The planned OTC framework will lead to consolidation and a reduction in the use of these platforms as on-ramps into crypto,” remarked Chengyi Ong, APAC policy head at Chainalysis.

This consolidation is part of Hong Kong’s broader strategy to position itself as a global crypto hub, ensuring a regulated and secure environment for crypto transactions amid growing concerns over Beijing’s influence.

Hong Kong’s regulatory pivot is not just about tightening the reins on crypto transactions. It also underscores a significant commitment to promoting a safe and regulated crypto environment. This is evidenced by the Hong Kong Monetary Authority’s recent guidelines on crypto custody.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

Be the first to comment