India’s central bank, the Reserve Bank of India (RBI), has warned about investing in the crypto market following the collapse of cryptocurrency terra (LUNA) and stablecoin terrausd (UST). “We have been cautioning against crypto and look at what has happened to the crypto market now,” said Governor Shaktikanta Das.

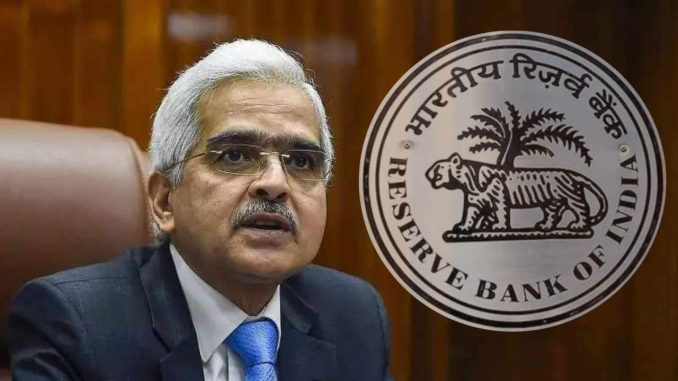

RBI’s Governor on Crypto Market and Regulation

The governor of the Reserve Bank of India (RBI), Shaktikanta Das, discussed the crypto market downturn and the regulation of crypto assets in an interview with CNBC TV18 Monday.

“We have been cautioning against crypto and look at what has happened to the crypto market now,” the governor said, stressing:

Had we been regulating it already, then people would have raised questions about what happened to regulations.

The crypto market has shed over $1.5 trillion since November last year and almost $500 billion since the beginning of the month. The market slump was exacerbated by the fall of cryptocurrency terra (LUNA) and algorithmic stablecoin terrausd (UST).

Describing cryptocurrency, Das said: “This is something whose underlying (value) is nothing.” He added:

There are big questions on how do you regulate it. Our position remains very clear, it will seriously undermine the monetary, financial and macroeconomic stability of India.

The RBI also recently warned that crypto could lead to the dollarization of the Indian economy.

The governor believes that the Indian government shares the central bank’s stance on crypto. “We have conveyed our position to the government and they will take a considered call,” the central bank chief noted. “I think the utterances and statements coming out from the government are more or less in sync. They are also equally concerned.”

Das was also asked about the statement made by Brian Armstrong, the CEO of cryptocurrency exchange Coinbase, who claimed that Coinbase India disabled payments by the Unified Payments Interface (UPI) days after launch due to “informal pressure” from the RBI.

“I would not like to react on speculative observations made by individuals outside,” the governor replied.

The Indian government has been working on cryptocurrency legislation for quite some time. Finance ministry officials have been consulting with the International Monetary Fund (IMF) and the World Bank on crypto regulation. Indian Finance Minister Nirmala Sitharaman said in April that the decision on crypto regulation will not be rushed.

Meanwhile, cryptocurrency income is currently taxed at 30% in India, and a 1% tax deducted at source (TDS) will start levying on crypto transactions in July.

What do you think about the comments by the RBI governor? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment