In the last 24 hours, Bitcoin miners dumped over 1400 BTC for $41.2 million. This abrupt movement has captured the attention of market enthusiasts, who observed that the action further increased the selling pressure in the market.

Ali Martinez, BeInCrypto’s Global Head of News, citing data from CryptoQuant, confirmed the steep decline in miners’ reserves during the reporting period.

Increased Sell Pressure Keeps BTC Under $30,000

Bitcoin miners’ sudden sell-off has increased the selling pressure on the flagship digital asset that has mostly traded under $30,000 for the past 30 days.

Crypto analyst Maartun validated this theory, pointing out that BTC’s sell-taker volume significantly outperformed taker buyers. He added that this was why BTC’s price was still under $30,000.

After a rapid rise at the start of the year, the Bitcoin price movement has been tepid at best recently, with the asset usually retreating anytime it crosses the $30,000 level. The asset has consolidated at around $29,000 for several weeks, barely budging despite the various events.

BeInCrypto previously reported that Bitcoin volatility is near its lowest level in the last two years. This was confirmed by prominent blockchain analytical firm Glassnode, whose report stated that fewer than 5% of the flagship asset trading days have a tighter trade range. It added that “several measures of [BTC] volatility [are] collapsing towards all-time lows.”

Sponsored

Sponsored

Will Optimism Around ETFs Help BTC to Breakout?

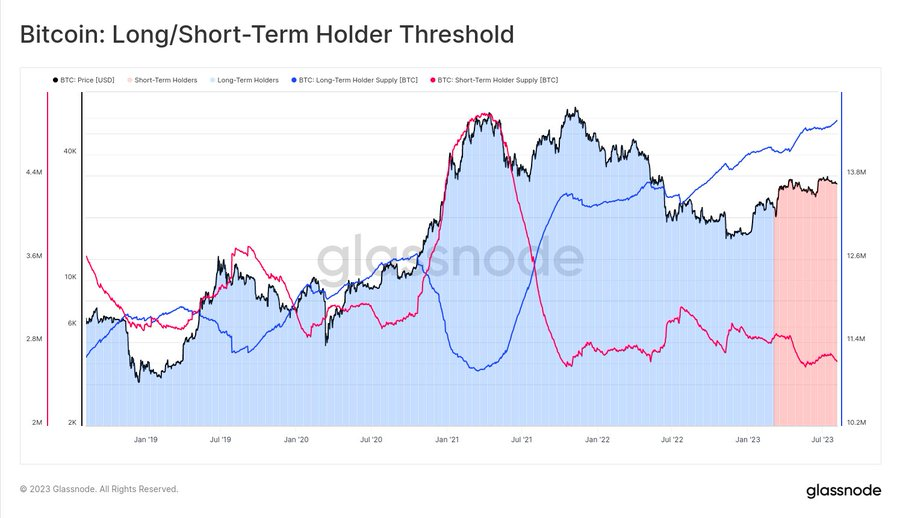

However, despite the recent lack of movement in BTC’s price, Glassnode data further shows that long-term holders’ assets reached a new all-time high of 14.59 million. This accounts for 75% of BTC’s circulating supply and shows their conviction in holding it.

Market observers have opined that holders are watching the market, anticipating the U.S. Securities and Exchange Commission’s decision on a Bitcoin Spot ETF application. Over the last two months, the financial regulator has received many applications from prominent traditional financial institutions, including BlackRock.

Stakeholders, including Ark Invest Cathie Wood and Galaxy Digital Mike Novogratz, have predicted that the SEC might finally approve an application before it. However, the regulator recently delayed its decision on one of these ETFs, opening a 21 days window for the public to comment on the application.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment