In an ever-evolving crypto ecosystem, Bitcoin’s potential to reach $60,000 in 2024 is gaining traction. This prediction aligns with the recent launch of spot Bitcoin exchange-traded funds (ETFs) in the US.

This milestone has significantly widened the investor base, potentially injecting approximately $3 billion into Bitcoin’s market, as estimated by CoinShares.

What Macroeconomic Factors Will Push Bitcoin (BTC) Price in 2024?

A confluence of macroeconomic factors is influencing Bitcoin’s trajectory. Monetary policy, particularly in the US, plays a crucial role. Rising interest rates have shifted focus to alternative stores of value, like US Treasuries. However, the anticipated Federal Reserve’s interest rate cut in early 2024 could bolster the allure of Bitcoin, juxtaposing it with traditional assets.

The weakening appeal of the US Dollar amid geopolitical shifts and supply chain changes further strengthens Bitcoin’s position. Concerns over US debt sustainability hint at diminishing confidence in the Dollar, inversely benefiting Bitcoin.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Inflation dynamics in developed countries, akin to post-2009 trends, suggest a likely Fed rate reduction. This monetary easing could enhance Bitcoin’s appeal in 2024 compared to US Treasuries, given Bitcoin’s fixed supply nature.

Another factor is the increased correlation between Bitcoin and traditional assets, driven by investors seeking stability amidst policy shifts and market stress. This trend is expected to be temporary, with Bitcoin likely to revert to its typical inverse correlation with the US Dollar within the next year.

Moreover, the high correlation between bonds and equities has steered investors towards more diversified assets, like Bitcoin. Its potential as an effective diversification tool beyond traditional asset classes is increasingly recognized.

Halving Cycle and Regulations in 2024

The Bitcoin mining industry is also changing, which is integral to its price dynamics. The mining cycle, influenced by Bitcoin’s price cycle, halvings, and lag in equipment deployment, is expected to experience significant shifts in 2024. The upcoming halving event in April is particularly crucial, potentially impacting mining profitability and market supply dynamics.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

In terms of regulatory outlook, 2024 seems promising. The US Securities and Exchange Commission’s (SEC) approval of a spot Bitcoin ETF sets a positive tone.

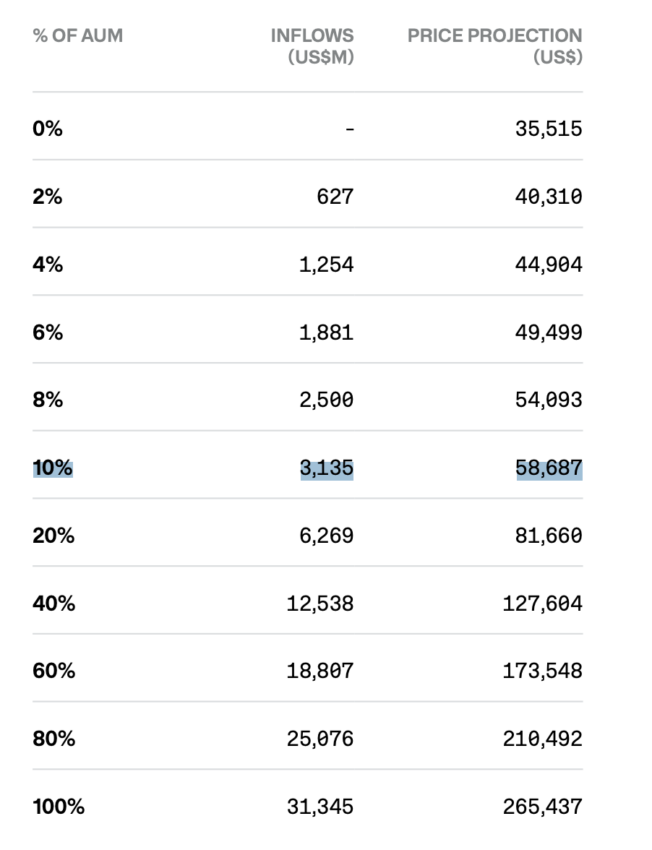

CoinShares analysts predicted that the inflow of 10% of current assets under management (AUM) could send the BTC price near $60,000.

“While predicting the exact scale of post-launch investment inflow is challenging, a conservative estimate suggests that 10% of the current AUM, which is approximately $3 billion, could raise Bitcoin prices to around $60,000,” wrote CoinShares.

Notably, there’s a global trend of regulation over outright bans, with countries like Hong Kong and Japan providing stablecoin guidance and the EU advancing the Markets in Crypto Assets Regulation (MiCA).

The overall sentiment towards digital assets, especially Bitcoin, is becoming increasingly positive. This amalgamation of macroeconomic factors, regulatory advancements, and intrinsic market dynamics makes a strong case for Bitcoin’s continued ascent in 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment