Altcoin/BTC spot trading pairs were once considered a key channel for investors to increase their Bitcoin holdings. However, this perception is fading. Data indicates a decline in interest, with many Altcoin/BTC pairs delisted in early 2025.

Meanwhile, Altcoin/USDT spot pairs remain the primary avenue for traders seeking profits.

Binance Delists Multiple Altcoin/BTC Spot Pairs

At the beginning of 2025, Binance removed several Altcoin/BTC spot pairs from its platform. Today, Binance announced the delisting of MDT/BTC, MLN/BTC, VIB/BTC, VIC/BTC, and XAI/BTC due to low liquidity and trading volume. This is not the first such announcement this year.

“To protect users and maintain a high-quality trading market, Binance conducts periodic reviews of all listed spot trading pairs and may delist selected spot trading pairs due to multiple factors, such as poor liquidity and trading volume,” Binance stated.

Since the start of the year, Binance has issued seven delisting announcements, affecting 34 spot trading pairs. Of these, 50% were Altcoin/BTC pairs, while the rest were Altcoin/ETH or Altcoin/BNB. Notably, the delisting of an Altcoin/BTC pair does not necessarily mean its corresponding Altcoin/USDT pair is removed (e.g., ENJ, C98, REZ).

This shift reflects traders’ preference for Altcoin/Stablecoin pairs, likely due to better liquidity and lower risk exposure.

Retail Investors Reduce Bitcoin Holdings While Institutions Accumulate

CryptoQuant data shows that retail investors have been reducing their BTC holdings since Q4 2024, while large investors continue to accumulate.

“Retail is panic-selling. Whales are accumulating,” Investor Mister Crypto commented.

Since the approval of Bitcoin ETFs and the start of Trump’s new term, Bitcoin has become a playground for institutional investors. Retail traders seem less interested, as BTC’s high price is out of reach for many. Instead, they hold fewer BTC and allocate more capital to altcoins, particularly meme coins.

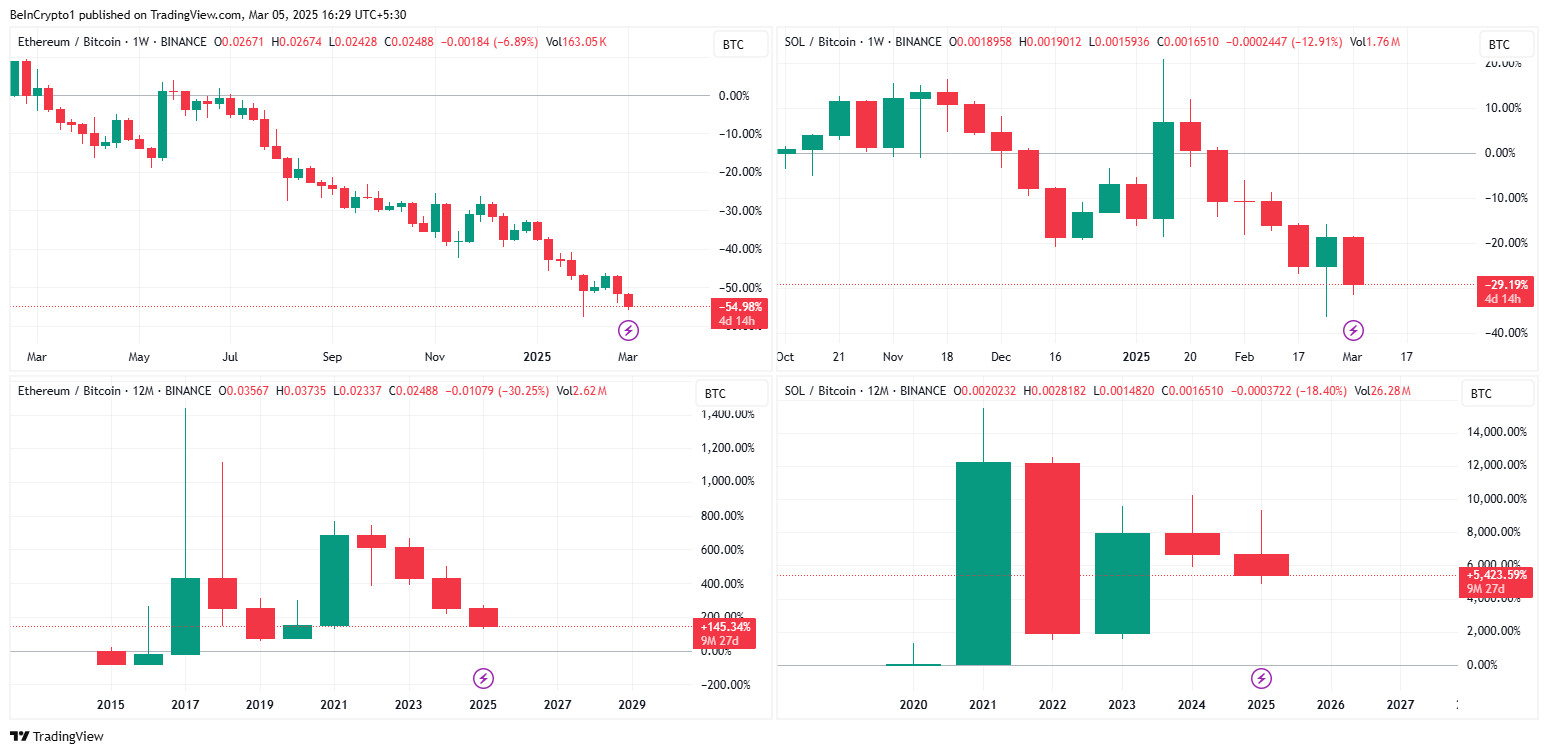

Furthermore, trading Altcoin/BTC pairs exposes traders to two risks simultaneously—the volatility of both altcoins and Bitcoin. Even the most liquid pairs, such as ETH/BTC and SOL/BTC, have shown prolonged downtrends and high volatility, increasing the risk of losses.

Market analysts also tend to focus on Altcoin/USDT spot pairs, leaving Altcoin/BTC pairs with less attention.

According to CoinMarketCap data, USDT’s daily trading volume exceeds $115 billion, out of a total market trading volume of $147 billion. This confirms that USDT remains the primary channel for traders seeking opportunities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment