Bitcoin has dropped below the $100,000 threshold as the broader crypto market experiences heightened volatility.

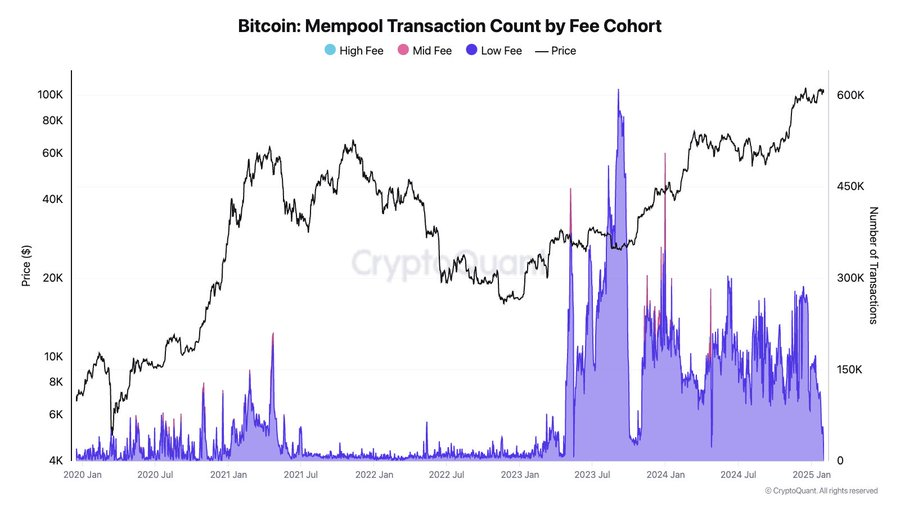

This downturn coincides with a significant decline in transaction activity on the Bitcoin network, bringing memory pool (mempool) volume to its lowest level since March 2024.

Market Downturn Wipes Out Over $500 Million in Liquidations

Over the past 24 hours, Bitcoin fell below $100,000, shedding over 4% of its value and briefly touching $98,000. Data from BeInCrypto indicates that Bitcoin initially peaked at $102,000 before succumbing to selling pressure.

The decline follows broader market instability, with the total crypto market cap losing 5% of its value. Other major cryptocurrencies also faced steep declines. Ethereum, Solana, and BNB each recorded losses exceeding 7%.

The increased volatility triggered a liquidation spree, wiping out over $555 million in leveraged positions, according to CoinGlass. More than 239,000 traders faced forced liquidations, with long traders—those betting on price increases—suffering the heaviest losses, amounting to $491 million.

Short traders, anticipating price declines, lost approximately $63 million.

The turmoil follows US President Donald Trump’s decision to enforce stringent tariffs on major trading partners, including Canada.

The administration claims the move is designed to curb the flow of undocumented immigrants and illicit substances into the US. However, the tariffs have sparked concerns about inflationary pressure on American consumers.

In response, Canadian Prime Minister Justin Trudeau announced retaliatory measures, imposing 25% tariffs on $106 billion worth of American imports.

The first round of levies, targeting $30 billion in goods, will take effect immediately, with an additional $125 billion in tariffs scheduled in the coming weeks.

Bitcoin Network Sees Sharp Drop in Transactions

Beyond market turbulence, Bitcoin’s network activity has declined significantly, with the mempool—the waiting area for unconfirmed transactions—showing a notable reduction in volume.

On February 1, data from CryptoQuant shows that the mempool is nearly empty, indicating a steep drop in transaction volume. The data further reflects that Bitcoin transaction fees have dropped to 1 sat/vB, signaling reduced demand for block space.

This marks the lowest level of transaction activity since March 2024.

This trend raises concerns about Bitcoin’s usage as a medium of exchange, with some analysts suggesting that the growing perception of BTC as digital gold may discourage transactional use.

Bart Mol, host of the Satoshi Radio Podcast, criticized the shift in narrative, stating that celebrating an empty mempool overlooks the potential risks to Bitcoin’s foundational role. He likened it to “wood rot” in a house’s foundation, warning that a lack of transaction activity could undermine Bitcoin’s core functionality.

“Bitcoiners celebrating that the mempool cleared is one of the most retarded things I’ve seen in a while. The digital gold narrative is slowly destroying the foundation of Bitcoin, like wood rot in the foundation of a house,” Mol wrote.

Indeed, Mol’s comment aligns with Bitcoin’s increasing adoption as a reserve asset. Several corporations and governments have begun considering Bitcoin for their treasuries. These narratives reinforce the token’s position as a long-term store of value rather than a transactional currency.

However, the ongoing decline in on-chain activity raises questions about Bitcoin’s long-term utility beyond being a digital gold reserve.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment