Robert Kiyosaki, author of the bestselling book Rich Dad Poor Dad, has warned that the biggest stock market crash in history is imminent. He predicts that expensive assets like houses, gold, silver, and Bitcoin will soon go on sale.

Kiyosaki’s statements come as the cryptocurrency market faces sharp corrections, attributed to a decline in US stocks like Nvidia and Tesla.

Robert Kiyosaki Anticipates Bitcoin Sell-Off

Kiyosaki took to social media to reiterate his long-standing predictions, attributing the looming crash to decisions made during the 2008 financial crisis. He claimed that leaders like former Federal Reserve Chairman Ben Bernanke prioritized bailing out banks over ordinary citizens.

“I WARNED Y’all. In 2013, I published Rich Dad’s Prophecy, which predicted the biggest stock market crash in history. That CRASH is NOW,” he posted.

Kiyosaki also warned that in 2025, the car and housing markets, restaurants, retailers, and even wine sales are crashing. He also acknowledged that the world was on the verge of war, which in his opinion, made everything worse.

“Please be smart. Many expensive assets will go on sale. I’ll be buying more real assets with fake US dollars,” Kiyosaki quipped.

The statement follows Bitcoin’s recent price drop, which fell from over $101,700 on Tuesday to $95,370 as of this writing. This represents a nearly 7% decline since the Wednesday session opened.

Nevertheless, Kiyosaki expressed optimism, demonstrating an intention to capitalize on the crash to buy more BTC.

“BITCOIN crashing. Great news. I continue buying Bitcoin because Bitcoin crashing means Bitcoin is on sale. Remember ‘Buy low…and HODL.’ Less than 2 million more Bitcoins to be mined,” he added.

Experts Link Bitcoin and Crypto to Stocks

Meanwhile, experts link the cryptocurrency market’s correction to a downturn in US stock prices. Greeks.live, a platform that analyzes crypto options, noted the correlation in a post on X (Twitter).

“Cryptocurrencies saw a sharp correction due to plummeting US stocks such as Nvidia and Tesla, with Bitcoin dropping below $100,000 again, and altcoins dropping even more violently,” Greeks.live wrote.

Despite this, the analysts at Greeks.live remain positive that the bull market is still there. Against this backdrop, they urge investors to capitalize on the correction to buy BTC at discounted rates. If you choose to take the plunge now, the $100,000 short-term call is very cost-effective.”

Bloomberg’s senior ETF analyst Eric Balchunas echoed similar sentiments. He drew a direct correlation between Bitcoin and stock market performance.

“US stock market woes… Not predicting it, just saying that is BTC kryptonite. I’m still skeptical BTC can go up if stocks are down,” he wrote.

When asked whether Bitcoin could prove resilient even amid stock market declines, Balchunas responded that if that happens, it would show a remarkable evolution from a risk asset to a safe haven. Nevertheless, he remains skeptical.

Adding to the debate, Adam Cochran, a crypto analyst, shared his perspective, noting that while he thought crypto was ripe for a breakout, its potential rally was limited by a “larger economic drag.”

“Large funds don’t move out the risk curve during a downturn,” he added.

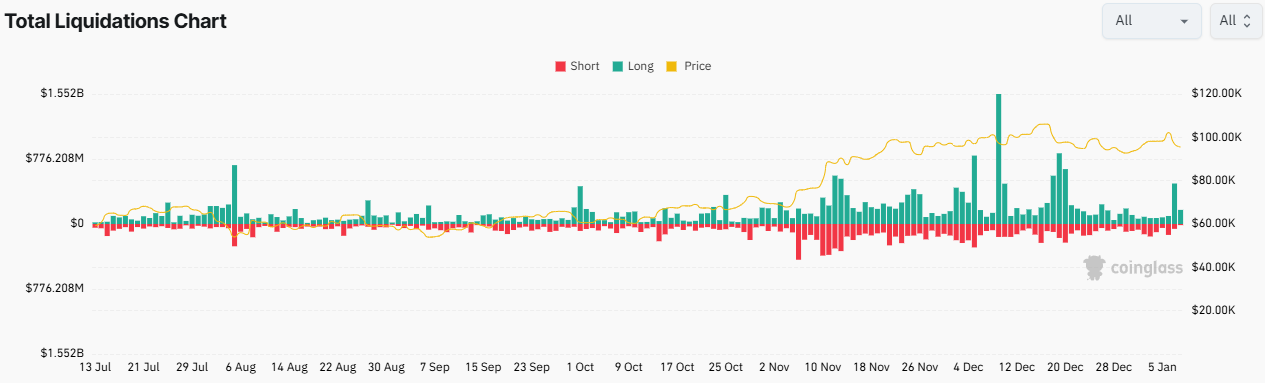

Meanwhile, Bitcoin’s current price dip has triggered widespread liquidations. According to data from Coinglass, over 236,481 traders were liquidated in the past 24 hours, amounting to $693.52 million in total liquidations.

The steep decline in Bitcoin’s price and altcoin markets reflects a broader pessimism in market sentiment, fueled by a strengthening US dollar and ongoing stock market volatility.

The crypto market’s performance continues to raise questions about its correlation with traditional financial markets. While some investors see the recent downturn as an opportunity to accumulate assets at lower prices, others remain cautious, citing macroeconomic uncertainties.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment