Crafting a compelling pitch for a crypto project is essential in capturing the attention of venture capitalists (VCs), who sift through hundreds of proposals weekly.

Still, invaluable insights can be learned into what VCs look for in crypto startups. These include outlining a blueprint for entrepreneurs to refine their approach, focusing on timing, clarity, market understanding, team composition, and community engagement.

Building the Perfect Pitch

Danilo Carlucci, Founder and CEO of Morningstar Ventures, told BeInCrypto that timing is critical. Startups should engage VCs only when they have a Proof of Concept (PoC) that demonstrates their product’s or service’s feasibility and potential. This stage is crucial for eliciting initial interest and feedback from investors.

Then, utilizing this feedback to refine the Minimum Viable Product (MVP) allows startups to showcase tangible achievements and metrics, making a stronger case for investment. According to Carlucci, proper timing and iteration of these stages, evidenced by quantifiable success metrics, significantly impact the project’s Future Diluted Valuation (FDV).

“Timing is such a difficult thing to get perfect. But if start-ups time their project stages correctly and iterate them, they can raise more funds, ultimately impacting their FDV,” Carlucci said.

He also emphasized the importance of clarity and conciseness in pitches. A successful pitch concisely articulates the problem being solved, the uniqueness of the solution, and the strategic use of capital. More importantly, clear go-to-market strategies and user acquisition plans are particularly compelling.

Read more: Crypto Marketing Truth: Advertising Cannot Buy Results

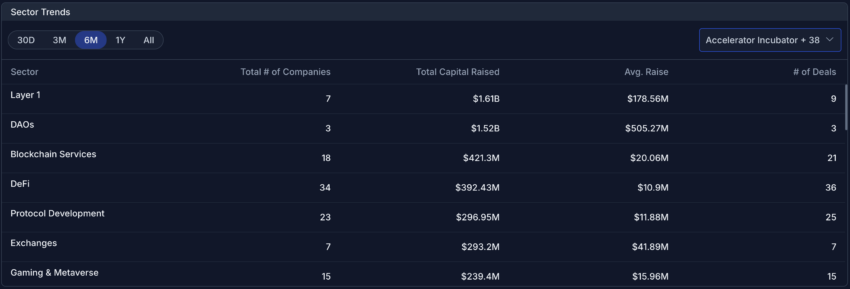

Projects that distinguish themselves through a well-defined unique selling proposition (USP), backed by thorough market and competitor analysis, stand out. Incorporating on-chain metrics and market trends can further enhance a project’s attractiveness by providing a clear picture of its potential.

“We’ve all heard it before. Less is more. As simple as it sounds, we value clear and concise pitches. Keep it short and sweet! Not only do VCs read through hundreds of pitches a week, but I firmly believe that the less time it takes to explain your project, the better it will be,” Carlucci advice.

Likewise, Samuel Huber, the CEO of Landvault and the Matera Protocol, told BeInCrypto that startups should pivot their focus toward hard metrics. These include profitability, burn rate, and capital efficiency, which are now paramount to investors. Even with the current enthusiasm in the crypto market, the broader economy will likely continue to adopt a cautious approach.

The emphasis on real revenue generation cannot be overstated. In the flux of market cycles, where bull markets often prioritize growth at the expense of solid business foundations, bear markets shift the focus back to fundamental metrics like revenue.

“Entrepreneurs should shift their focus towards metrics that investors prioritize. Indeed, crypto startups need to demonstrate their ability to generate real revenue. They must focus on showcasing practical business models rather than solely emphasizing decentralization,” Huber explained.

The path to funding is fraught with challenges. “There’s a tightening of funds for startups with unproven business models and poor execution,” Huber noted. He emphasized the importance of demonstrating tangible business metrics over mere projections. This calls for a meticulous focus on building a solid business that stands out in a bear market.

Tokenomics and the Dream Team

Moreover, the team behind a project is a critical factor for VCs. Carlucci emphasized that VCs invest in people as much as in ideas. Therefore, a team’s track record, complementarity, and vision are scrutinized. The team’s openness to collaboration and feedback and a proactive approach significantly influence a VC’s investment decision.

In this regard, most VCs look for teams with a strong track record and extensive experience in their field.

“The team is everything! No matter the tech, the design, or the idea, most VCs invest in people; therefore, the team and the vision of the founder is crucial,” Carlucci said.

Tokenomics and crypto narrative trends play a crucial role in attracting investment. Projects must design tokenomics that align VCs’ interests with the project’s long-term vision, ensuring a vested interest in the project’s success. Likewise, entrepreneurs must align their projects with prevailing crypto narratives, striving to position themselves as leaders within these spaces.

Despite the inherent risks in the crypto industry, Carlucci suggested that a well-articulated USP and comprehensive market analysis can address potential concerns and demonstrate the startup’s awareness of and preparedness for challenges. Meanwhile, Huber highlighted the importance of utility and adaptability.

“Generally, projects within infrastructure sectors are highly attractive to investors due to their potential for broader utility. While applications certainly create value, infrastructure projects influenced by narrative trends such as NFTs, the metaverse, DeFi, RWA, or the creator economy offer a foundation that can be leveraged by others, thereby enhancing their resilience,” Huber added.

Trust is also a critical factor in investment decisions. VCs prefer to back founders they know and trust, reflecting the importance of building a strong company and networking to enhance credibility. In Huber’s view, the journey to securing VC funding in the crypto market is as much about showcasing resilience and innovation as it is about navigating the nuances of investor expectations and market dynamics.

Indeed, Carlucci highlighted the importance of selecting the right VC partners. Startups should seek strategic partners offering more than capital, such as user access, networking opportunities, and industry expertise.

Read more: GSD Capital Review: A Guide to the AI-Powered Hedge Fund

By focusing on timing, clarity, team dynamics, tokenomics, and strategic partnerships, startups can increase their chances of attracting the necessary funding to propel their projects forward. Adhering to these principles is instrumental to securing venture capital funding in the crypto market.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment