Jimmy Song is among the names in the Bitcoin landscape that don’t require an introduction. He has been involved with the BTC ecosystem for about a decade, from being a developer and supporter of the network to publishing several books on the matter, trying to educate the masses about Bitcoin’s advantages, whether in terms of developers or retail investors.

CryptoPotato had the chance to speak with Song during the Bitcoin Conference 2023 in Amsterdam, where we talked about various BTC-related topics, such as Ordinals, ETFs, the blockchain’s future, and others like inflation and money printing.

‘Don’t Care Camp’ on Bitcoin ETFs

Whether or not the US will finally have a spot Bitcoin ETF has been on the minds of many, with some, such as Edward Snowden, refusing to accept a possible approval for a positive development while others believe such a product will help legitimize the cryptocurrency, especially for institutional investors.

Speaking on the matter, Jimmy Song said he stands in the “I don’t care camp.”

“A lot of people are wanting it to mean something and just because it has been sort of a promise for a long time. However, we have had futures ETFs for a while now in the US. We’ve had spot ETFs all over the world for a while now.”

He acknowledged the fact that some institutional investors will be able to have an easier entrance to the BTC ecosystem, but they will also have the option to employ short ETFs, which is “going to be very dangerous” since redemptions of the spot product will have to be delivered in actual Bitcoin.

While opining on another hot topic from earlier this year – Bitcoin Ordinals – Song categorized them as a “normal pump and dump.” He believes such schemes typically take place on altcoins, such as the DeFi summer and the NFT craze – both of which were primarily on Ethereum.

This time, it was on Bitcoin, which was the unexpected part. Nevertheless, the author of five BTC books believes the hype around the Ordinals has “already come and gone,” and he added that “I don’t think it matters at all.”

Are We Still in the Wild West Era?

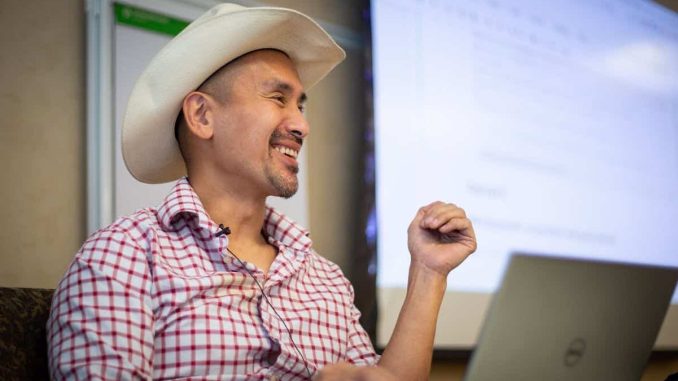

In his first interview with us from five years ago, Song said he wears his famous cowboy hat to showcase that the Bitcoin industry is in the Wild West era as it lacked regulations and any real adoption. When asked five years later if he had seen any developments on the matter, Song, who was still wearing the cowboy hat, said:

“I would say we are still in it, but maybe a little bit later in the Wild West era, when you had bounties and stuff like that. But I think in the past five years, we saw just so many scams, and nothing sort of encapsulates that more than Sam Bankman-Fried, who’s now on trial. So some of the wildness is being reined in, especially by the authorities with the prosecution of SBF, but also just more regulation in general.”

When it comes down to Bitcoin specifically, Song said, “I have seen a lot of regulators sort of recognize that it’s very different than everything else.”

Separately, Song said five years ago that he believed a lot more people would look for “freedomish” assets like Bitcoin within the next 15 years, which would strengthen BTC’s adoption curve. With governments using the COVID-19 pandemic to implement more control on the global population and the imminent launch of CBDCs, we asked Song whether he still has the same projection on the future of Bitcoin.

He admitted that most people “gave in” a bit too easily when the pandemic broke out, and especially when the vaccines were introduced. The controversial results and reports since then are making people ask themselves whether they would undertake the same steps as they did a few years ago when everything was so new to us.

As such, Song believes most people will be looking for alternatives and better education before making such big decisions. In terms of CBDCs, he said many will comply with them once they are fully launched, but a large chunk of the population has become a lot more skeptical. This was exemplified by the Canadian truckers, the farmer protests in a few European countries, and other similar events.

He added that the whole process of people seeking alternatives and becoming more freedom-minded is a long one:

“So, maybe it’s not 10 or 20 years, but 50 years from now, I think you are going to see a population that’s way more freedom-minded.”

Fiat Ruins Everything

When trying to fight the consequences of the COVID-19 pandemic, world governments essentially closed almost everything – from small and large businesses to people in their homes. In some countries, this was done for weeks, while in others – months and even years.

To alleviate some of the financial pressure, authorities, especially in the Western world, decided to print tons of fiat money and distribute them among their population. Whether that was successful or not is hard to determine, but the impact on the global economy is seen with inflation skyrocketing across the globe. Of course, some governments are trying to place the blame on the Ukraine-Russia war or something else.

In his fifth and latest book focusing on Bitcoin’s advantages, Song weighed in on the matter, which is evident by its title – Fiat Ruins Everything.

He asserted that it is aimed at a different audience than his previous books – this one is “squarely” for Bitcoiners – “the people that already own Bitcoin, and to help them understand how bad the fiat corruption has gotten and to sort of rally the troops a little bit. This is the anthem, a way to understand just what kind of a corrupt system they are escaping through Bitcoin.”

Featured Image Courtesy of YouTube

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Be the first to comment