Today marks 240 days since an event the Ethereum community has come to know as “the merge.” And its effects on the total ETH supply are clear.

Arguably the most significant upgrade in its history, the merge saw the Ethereum network transition from a Proof of Work (PoW) consensus mechanism to one based on Proof of Stake (PoS). Now, eight months on from the pivotal event, the long-term consequences of the merge are becoming apparent.

ETH Supply Declines

According to the Ethereum analytics dashboard ultrasound.money, nearly 650,000 ETH has been burned since the merge. In the same time span, just under 424,000 new ETH have been minted. The result is a net supply change of around -226,000 ETH.

As a percentage of the total supply, the numbers represent a decrease of 0.213% or 0.285% annualized.

Had the merge not happened, ultrasound.money estimates that the total ETH supply would have increased at a rate of 3.244% per year in the same period.

Long-term Ether holders will likely welcome the news. After years of increasing supply, the higher burn rate in the past 240 days represents a deflationary trajectory. This could reward investors by pushing the price of ETH up.

Driving Ethereum’s post-merge supply dynamics is a technical change that saw the network replace miners with validators. Crucially, validator rewards are significantly less than the mining rewards issued under the PoW system.

This is because operating a validating node is not as economically intense as running a mining node.

According to the Ethereum Foundation, before transitioning to PoS, miners were issued around 13,000 ETH a day. Since the merge, however, the only fresh Ether issued is the roughly 1,700 ETH a day that goes to stakers.

In addition to the lower reward mechanism enacted by PoS as opposed to PoW consensus, higher burn rates are also driving ETH deflation.

Evolving Ethereum Mechanics

In the months since the merge, the dynamics of PoS-era ETH supply have come into sharper focus. But the question of how long the network can maintain deflationary economics remains.

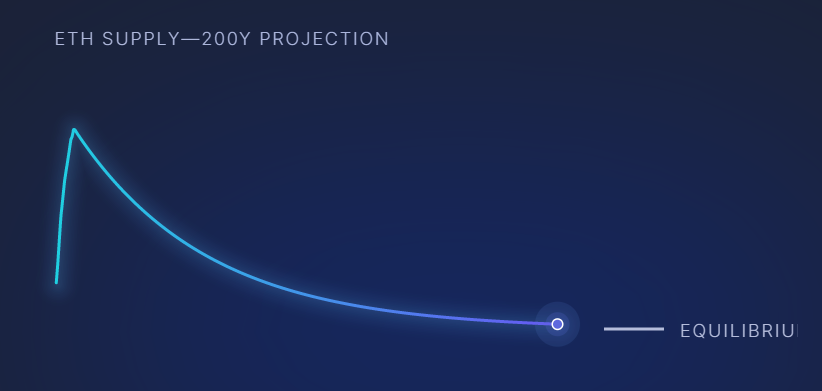

According to existing assumptions, then issuance as a proportion of the circulating supply will rise until it equals the rate of Ether burned. This will eventually lead to a circulating supply equilibrium where issuance equals burn rate.

Based on contemporary average staking rewards and burn rates, the creation and destruction of ETH are set to converge at around 709,000 ETH per year.

Mathematical models have placed the total circulating supply at equilibrium as between 27.3 and 49.5 million ETH.

Considering today’s supply of over 120 million ETH, if current trends continue the total supply will continue shrinking. Under the above assumptions regarding equilibrium, the deflationary trajectory will thus continue for many years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment