Mantle (MNT), an Ethereum layer-2 (L2) project, has recently gained widespread attention.

MNT, its native cryptocurrency, has also outperformed tokens from other blockchains in the same category. However, this analysis focuses on a recent change.

Fall in Mantle TVL Drives Ripple Effects on the Network

According to DeFiLlama, Mantle’s Total Value Locked (TVL) reached an all-time high of $636.50 million on July 24. TVL, as it is commonly called, measures the value of assets locked or staked in a protocol.

The higher the TVL, the more trustworthy a network is perceived to yield gains. However, if the TVL decreases, it implies that market participants are withdrawing previously-locked tokens.

Seven days after reaching the peak, Mantle’s TVL has decreased to 589.13 million. The decrease highlights the growing prevalence of lower benefits and proceeds on the lending, staking, and cross-chain protocols developed under Mantle.

Read more: What Is Mantle Network? A Guide to Ethereum’s Layer 2 Solution

The decrease also seems to have affected MNT’s price. Some days ago, the cryptocurrency’s price climbed by double digits. But afterward, profit-taking tanked the upswing. Since then, MNT has struggled to rebound, as it trades at $0.75 at press time.

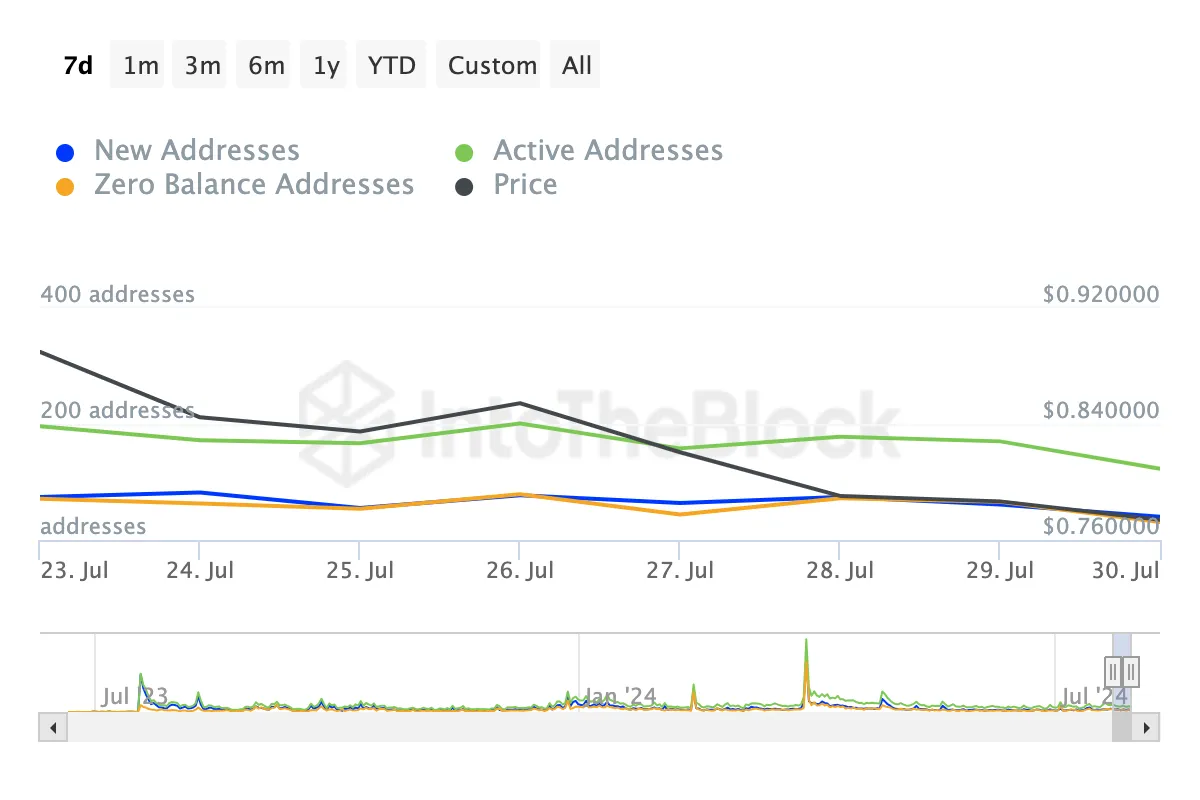

Additionally, data from IntoTheBlock indicates that Mantle network activity has faced challenges in recovering. To gain a clearer understanding of the network’s activity, BeInCrypto examines the condition of active and new addresses.

In simple terms, active addresses estimate the number of users on a blockchain. If the number increases, it implies that there is a lot of interaction with the native token, and this could be bullish for the price. A decline in the metric implies otherwise.

New addresses, on the other hand, track the number of first-time transactions on the blockchain. As a measure of traction, an uptick in the number suggests increased adoption, while a downturn implies decreased demand.

As shown above, active, new, and zero-balance addresses on Mantle have all declined in the last seven days, reflecting a drop in interaction with the MNT token. Should this continue, MNT’s price may find it challenging to rebound from its recent lows.

MNT Price Prediction: Downward Pressure Lingers

Based on the daily chart, the Moving Average Convergence Divergence (MACD) has dropped into negative territory. The MACD is a technical indicator that uses correspondence between two Exponential Moving Averages (EMAs) to determine momentum and price trends.

From the chart below, the 26-day EMA (orange) is above the 12-day (EMA), suggesting sellers’ dominance and a bearish momentum. If the shorter EMA is above the longer one, then the trend would have been bullish.

If the trend continues, MNT may not escape another drop and the Fibonacci retracement series gives an idea of the levels the token may reach. Should selling pressure increase, MNT’s price may decrease to $0.70 — where the 23.6% Fib level lies.

Read more: Layer-2 Crypto Projects for 2024: The Top Picks

However, a surge in buying pressure, combined with increased network activity, may invalidate the thesis. If this happens, MNT may bounce to $0.83 or as high as $0.89.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment