Post-“shapella” upgrade optimism that briefly lifted the Ether (ETH) price to 11-month highs in the mid-$2,150s earlier this month has mostly faded.

Ether, the token that powers the smart-contract-enabled Ethereum blockchain, was last trading close to $1,900, still up around 4% for the month, but over 11% below earlier monthly peaks.

Despite the fact that the ETH have been taking a breather in the last few weeks, analysts remain optimistic on the cryptocurrency’s medium to long-term prospects.

That’s in part because macro conditions continue to shift in favor of blue-chip (high market cap, high trust) cryptocurrencies like Bitcoin and Ethereum.

Bank crisis concerns continue to bubble with First Republic just taken into FDIC receivership and the Fed’s tightening cycle, while having a little way to go yet, looks to be coming to an end soon.

That means blue-chip cryptos will likely continue to benefit from 1) safe-haven demand as a “alternative” form of money and 2) easing financial conditions (i.e. a lower US dollar and US bond yields).

But unlike Bitcoin, Ether can also rely on the support of two key deflationary tailwinds that are likely to drive significant price upside in the coming years.

ETH’s Supply Deflation Rate Keeps Rising

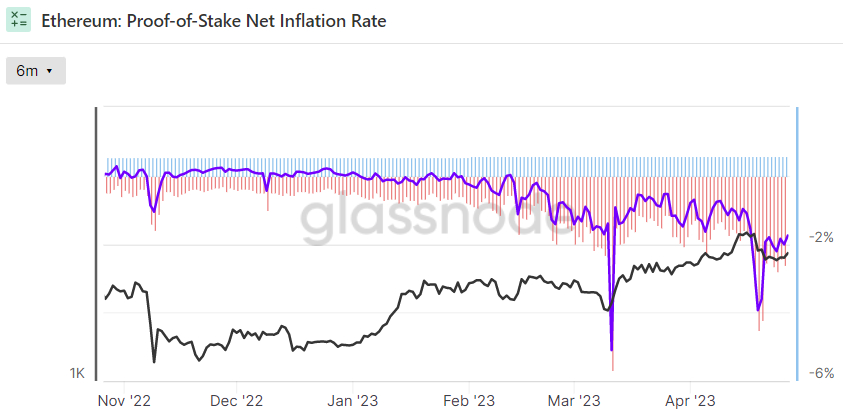

The rate at which the Ether supply is deflating continues to trend higher.

On Thursday, the Annualized EIP-1559 Burn Rate surpassed the ETH Issuance Rate by 1.753%, a week after the deflation rate nearly hit its annual peak a week earlier at 3.933%.

The net inflation rate has been negative more-or-less every day since the end of January, according to chart data presented by crypto analytics firm Glassnode.

When the deflation rate increases, that means that individual ETH tokens are becoming scarcer at a faster rate. Most analysts think this ought to boost the cryptocurrency’s price in the long run.

The rising deflation rate is linked to a rise in Ethereum network fees.

Network fees are split into two components. The first is a base fee that all users must pay to ensure that their transaction is accepted and processed on the blockchain.

There is then an optional tip that users can pay to have their transaction processed more quickly.

The Ethereum network automatically calculates the base fee, which rises at times of heavy network traffic.

Ethereum Improvement Proposal (EIP) 1559, which was implemented into the Ethereum code in the London hardfork in August 2021, requires that all of these base fees paid by users are then burned, removing the tokens from circulation permanently.

As a result, when the base gas fee rises, the rate at which Ether is burned also rises.

When this burn rate exceeds the ETH Issuance Rate, which is around 0.55%, the ETH supply will decline.

ETH is issued to the nodes and stakers that secure the Ethereum network.

The Supply of Unstaked ETH Tokens is Rapidly Falling

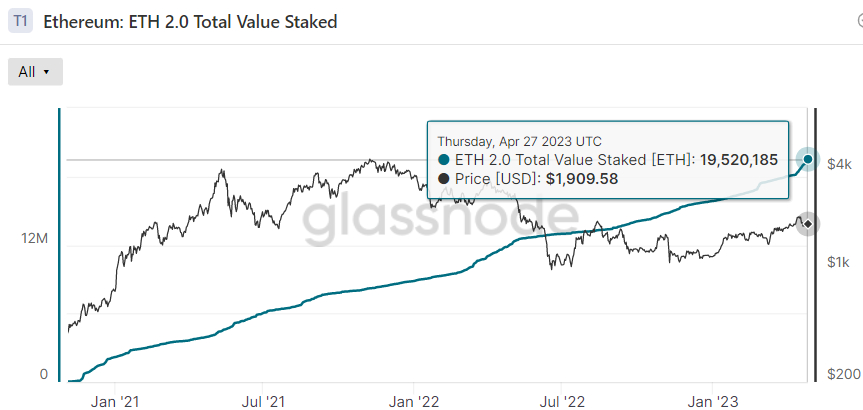

The (unstaked) ETH price is also likely to benefit from an ongoing, rapid drop in supply as more and more investors stake their ETH tokens to secure yield.

The recent “shapella” upgrade enabled the withdrawal of unstaked ETH tokens for the first time since staking was introduced to the Beacon chain in December 2020 (at a maximum rate of 50,400 ETH tokens per day).

As a result of the recently added flexibility to ETH staking, investors have been piling their ETH tokens into the staking contract at a faster rate than the 50,400 ETH token withdrawal limit.

As per data presented by Glassnode, the number of staked ETH tokens shot to new record highs above 19.5 million on Thursday, up around 1.5 million on the month.

Given the current ETH supply of around 120.4 million, that means only just over 16% of tokens are currently staked.

That’s well below other comparative proof-of-stake layer-1 blockchains like Cardano, which normally has a staking participation rate in the 60-70% of supply area.

As more ETH tokens are locked into the staking contract, where they are stuck behind the 50,400 ETH tokens per day withdrawal limit, the supply of readily available (unstaked) ETH tokens on the market declines, raising scarcity.

Theoretically, this should push up the ETH price.

Both Deflationary Tailwinds Set to Pick Up

It would be reasonable to expect that the ETH staking participation rate could rise to the 40-50% in the coming years, meaning tens of millions of (unstaked) ETH tokens being removed from immediately circulating supply.

Meanwhile, history suggests that Ethereum transaction fees and the burn rate could also shoot higher, sending the ETH supply deflation rate sharply higher in the process.

Back in early 2022, high network congestion consistently drove the daily annualized ETH (EIP 1559) burn rate frequently as high as 6.0%.

At the time, the Ethereum blockchain was still powered by the much more energy-intensive proof-of-work consensus mechanism and, as a result of the much higher energy fees and miner rig costs incurred by the miners that powered the network, Ethereum’s issuance rate was much higher at around 4.4-4.6% per year.

That means that Ether’s deflation rate only hit a maximum of around 1.5%.

However, if a resurgence in the broader crypto and DeFi market can send the EIP 1559 burn rate back to its early 2022 highs, the new much lower ETH Issuance Rate (in the 0.5-0.6% area) means Ether’s deflation rate could jump to a staggering 5.5%.

It’s worth noting that, eventually, upcoming Ethereum blockchain upgrades (perhaps later this year or in 2024), including the implementation of sharding, should bring down transaction fees as keep this deflation rate in check.

Dual inflation tailwinds could well mean that Ether outperforms Bitcoin during the upcoming crypto bull market.

If Bitcoin is to 5x from current levels to hit $150,000 in the coming years, as many seem to expect, does that mean that Ether could 6x or 7x to rally into the $10,000s?

Be the first to comment