The Blur (BLUR) price increased by 30% in the early morning hours but has retraced a large portion of that increase since.

It is possible that the increase occurred because UPbit Global exchange listed the token for trading. In any case, the price has not confirmed its bullish reversal yet due to its failure to close above a long-term resistance line.

Will BLUR Price Breaks Out From 133-Day Resistance Line?

The technical analysis from the daily time frame for BLUR shows that the price has fallen under a descending resistance line since Feb. 24. The decrease led to a low of $0.28 on June 10. The price has moved upwards since then.

The rate of increase accelerated on June 27, causing the BLUR price to move briefly above the resistance line. The line has been in place for 133 days.

However, despite the increase, BLUR has not reached a daily close above this line yet. Doing so is required to confirm the bullish trend.

While the price action is not bullish yet, the RSI is. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The indicator is increasing, is above 50, and has broken out from a descending resistance line (green icon).

Since RSI breakouts often precede price breakouts, the BLUR price may soon move above the resistance line. However, a look at a lower time frame is required to confirm this.

BLUR Price Forecast: Relief or Reversal?

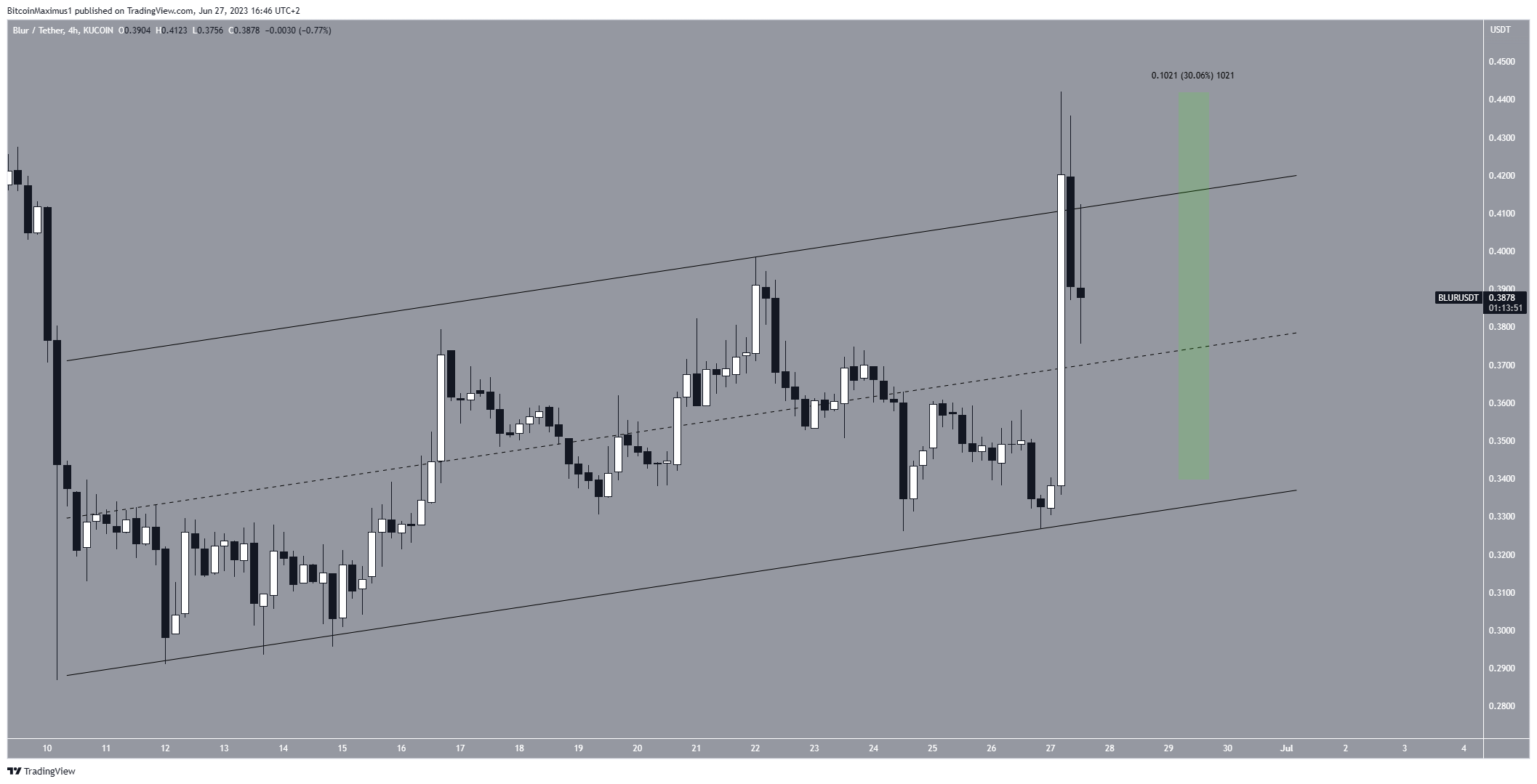

A closer look at the four-hour chart does not confirm if the price will break out from the long-term resistance line.

The main reason is that the BLUR price currently trades inside an ascending parallel channel. The channel is considered a corrective pattern, meaning that it leads to breakdowns most of the time.

However, BLUR briefly moved above the channel’s resistance line on June 27 before falling below it again. This allows for the possibility that the current upward movement is corrective and new lows will follow.

Therefore, if the price breaks out from the short-term channel, it will also confirm a breakout from the long-term line. In that case, an increase to $0.65 could follow.

However, if the BLUR price resumes its descent, it could drop to the channel’s support line and possibly break down. Then, lows near $0.25 will be expected.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

Be the first to comment