BlackRock, the world’s largest asset manager, is seeking to amend its Bitcoin ETF (IBIT), which has been the top-performing ETF among its peers since launching on January 11.

Bitcoin ETFs continue to attract institutional demand, bringing Bitcoin exposure to Wall Street and expanding its reach beyond retail investors.

BlackRock Files Bitcoin ETF Amendment

In a filing with the US Securities and Exchange Commission (SEC) on September 16, BlackRock requested that Bitcoin withdrawals from Coinbase, which acts as custodian for the asset manager’s IBIT, be processed within 12 hours.

“Subject to confirmation of the foregoing required minimum balance, Coinbase Custody shall process a withdrawal of Digital Assets from the Custodial Account to a public blockchain address within 12 hours of obtaining an Instruction from Client or Client’s Authorized Representatives,” an excerpt in the filing read.

This request comes as investors raise concerns about Coinbase’s custodial practices for Bitcoin ETFs. Specifically, investors want Coinbase, as custodian, to provide on-chain proof of Bitcoin purchases for ETFs to ensure transparency.

The concerns have arisen due to Bitcoin’s stagnant price performance over the past three months, despite large inflows into Bitcoin ETFs. Some speculate that Coinbase might be using “paper BTC” or Bitcoin IOUs for ETF issuers, potentially contributing to the lackluster price movement.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Amidst the concerns, Coinbase CEO Brian Armstrong pushed back in a bold attempt to counter fear, uncertainty, and doubt (FUD).

“All ETF mints and burns we process are ultimately settled onchain. Institutional clients have trade financing and OTC options before trades are settled onchain. This is the norm for all our institutional clients. All funds are settled in our Prime vaults (onchain) within about one business day,” Armstrong wrote.

In hindsight, Tron founder Justin Sun first raised concerns by questioning Coinbase’s Bitcoin wrapper, cbBTC, and criticized the exchange for lacking proof of reserves, warning it could mark “dark days for Bitcoin.”

BlackRock’s recent move to amend its Bitcoin ETF aims to address these concerns. The modifications suggest the asset manager’s efforts to enhance operational frameworks while improving liquidity. ETF analyst Eric Balchunas also minimized the speculation.

“I get why these theories exist and people want to scapegoat the ETFs. Because it is too unthinkable that the native HODLers could be the sellers. But they are… All the ETFs and BlackRock have done is save BTC’s price from the abyss repeatedly,” Balchunas said.

Coinbase as a Potential Single Point Of Attack

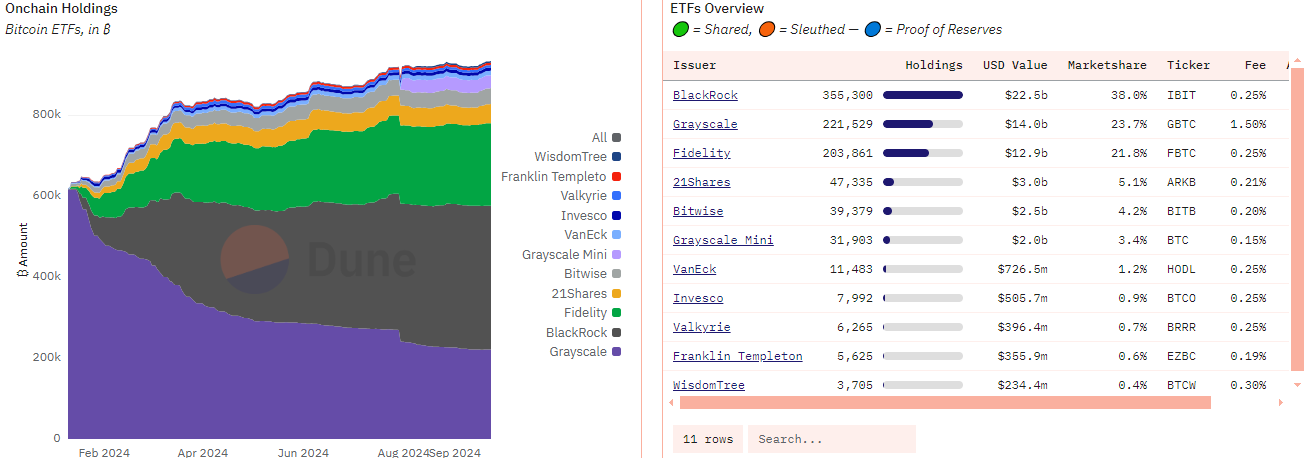

Indeed, Bitcoin ETF inflows have been massive since the financial instrument hit markets on January 11. Dune data shows that BlackRock’s IBIT dominates the sector, holding over 38% of the market share and managing $22.5 billion in on-chain assets.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Coinbase plays a dominant role in the crypto spot ETFs market, providing custody services for eight of 11 Bitcoin ETFs and eight of nine Ethereum ETFs. It also offers trading execution and market surveillance services.

Coinbase manages around 90% of the $37 billion in Bitcoin ETF assets, leading to concerns about its position as a potential single point of failure. Fox Business reporter Eleanor Terrett, among others, recently raised concern about this position of influence.

“It doesn’t bode well that nearly all crypto ETF issuers have the same custodian for all their BTC and ETH. This makes Coinbase a potential single point of failure and that’s scary,” Terrett wrote.

Beyond the latest concerns about possible IOUs to investors, the threat from North Korean hackers also positions Coinbase as a single point of attack should the bad actors target the custodian. Despite these concerns, the platform continues to play a critical role in institutional Bitcoin investment, operating a substantial portion of the US-based BTC spot trading market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment