What’s Causing the Bitcoin Downturn?

Just as it seemed we were moving past the FTX debacle, the bankrupt crypto exchange had one more surprise in store for us.

Over the past few weeks, FTX’s bankruptcy trustee liquidated 22 million shares of the Grayscale Bitcoin Trust (GBTC), worth approximately $1 billion. This has placed significant downward pressure on Bitcoin.

The good news is that, according to Coindesk, FTX is now done selling its former GBTC holdings. This should slow down the selling pressure being exerted on BTC.

Despite FTX selling $1 billion worth of GBTC, overall the Bitcoin ETFs have resulted in net inflows to Bitcoin of approximately $721 million, as of January 23, according to Bitmex Research.

So to clarify, the Bitcoin ETFs are not causing the current sell-off. Thus far these recently approved funds are still a net positive, resulting in more Bitcoin being purchased than is being sold. It seems likely that GBTC will continue to sell off due to its abnormally high fees (1.5%). But so far the new ETFs are more than making up for GBTC’s outflows.

There’s still more to the story though. We have more potential sell-pressure which could hit the market in 2024.

Mt. Gox Distributions Loom

The primary bearish catalyst today seems to be the upcoming distribution associated with the 2014 Mt. Gox hack.

After a decade, users who lost their BTC on Mt. Gox are scheduled to get about 20% of their original holdings back. An estimated 142,000 Bitcoin could soon be distributed by the bankruptcy trustee in Japan. At $40,000 BTC, that’s more than $5 billion worth of coins.

That 142,000 coins will be distributed to users as BTC, so each will have the choice to sell or not. It’s difficult to predict what percent of these long-lost Bitcoins will be sold, and which will be held. I’d guess a majority will be sold.

It’s worth noting that the $5 billion worth of BTC, which could be soon hitting the market from Mt. Gox, should be almost precisely offset by the decrease in Bitcoin production we’ll see in the first year after the April 2024 halving.

Bullish Catalysts Intact

On the positive side, the three bullish factors we discussed last month are still looking good.

- Bitcoin ETFs – approved and inflowing

- Bitcoin halving – happening in April

- Fed pivot – seems likely this year

Now that ETFs are approved and the halving is only a few months out, I am primarily focused on the one unknown left – the possibility of a Federal Reserve pivot.

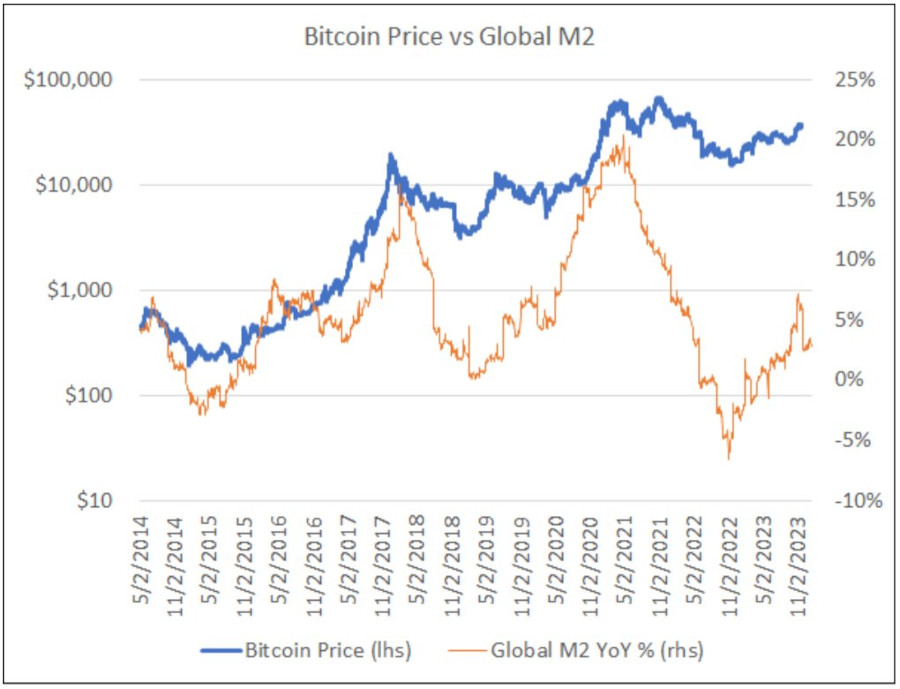

Here’s a chart demonstrating that, courtesy of the talented Lyn Alden:

If the Fed does indeed pivot shortly, that could be the deciding factor for which direction Bitcoin’s price goes over the short term. Historically, Bitcoin has reacted bullishly to lower interest rates and QE (quantitative easing, AKA money printing).

Cheers,

Adam Sharp

The HIVE Newsletter

Be the first to comment